SINGAPORE — Chinese stocks fell sharply Tuesday afternoon, as investors weighed a possible thawing of U.S.-China trade relations after U.S. President Joe Biden floated the idea of tariff cuts on Chinese goods.

Hong Kong's Hang Seng index pared earlier losses to close 1.75% down to 20,112.1, while the Hang Seng Tech index fell more than 3%. Alibaba was down 2% while Tencent declined 2.48%.

Shares of electric vehicle maker Xpeng plummeted more than 9%, after it reported on Monday that its first-quarter net loss widened to 1.7 billion yuan ($254.7 million), from 786.6 million yuan a year earlier.

The Shanghai Composite fell 2.41% to close at 3,070.93, while the Shenzhen Component declined 3.34% to 11,065.92.

In Japan, the Nikkei 225 declined 0.94% to close at 26,748.14, while the Topix closed 0.86% down to 1,878.26.

Stock picks and investing trends from CNBC Pro:

Japan's manufacturing activity for May increased at the slowest pace in three months, as supply bottlenecks caused output to slow, according to Reuters.

In corporate news, Toyota Motor said Tuesday it will cut global production by around 100,000 to 850,000 in June, due to the semiconductor shortage. Shares of the Japanese automaker were down 0.56%.

South Korea's Kospi was down 1.57% to finish at 2,605.87. In Australia, the S&P/ASX 200 declined 0.28% to 7,128.80.

MSCI's broadest index of Asia-Pacific shares outside Japan was lower by 1.3%.

Markets seemed to take the news as indicative of a potential thawing of US-China trade tensions, though it isn't the first time tariff reductions have been floated.

Taylor Nugent

economist, National Australia Bank

U.S. markets offered some relief for investors as stocks rallied following a week of sharp losses. During Monday's regular trading session, the Dow jumped 618 points, or nearly 2%, the S&P 500 rose 1.9% and the Nasdaq Composite gained 1.6%.

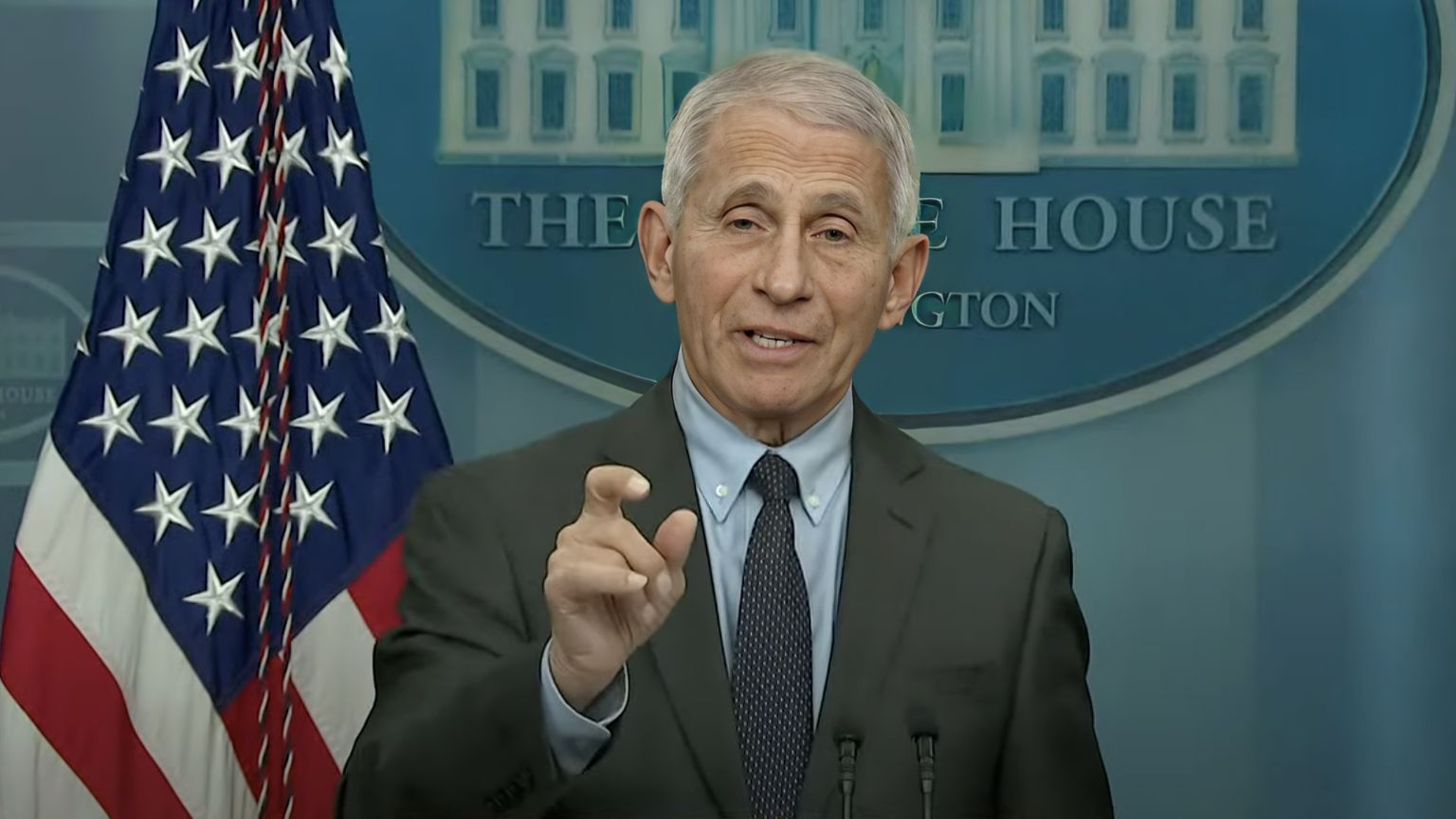

Sentiment appeared to have gotten a boost after U.S. President Joe Biden said he was considering cutting U.S. tariffs on Chinese goods, at a press confidence during his trip in Japan as part of his first Asia tour.

As consumer prices heated up, the White House had said last month that it was looking at how those tariffs have contributed to inflation.

Those tariffs took effect in 2018 when the Trump administration imposed tariffs on billions of dollars worth of Chinese goods and Beijing retaliated with similar punitive measures, drawing both sides into a protracted trade war.

"Markets seemed to take the news as indicative of a potential thawing of US-China trade tensions, though it isn't the first time tariff reductions have been floated," wrote Taylor Nugent, an economist at the National Australia Bank. "While a cut to tariffs would help soften US inflation at the margin, reports suggest administration officials are concerned about appearing soft on China ahead of November congressional elections."

Currencies and oil

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 101.827 — falling from levels around 102 earlier.

The Japanese yen traded at 127.43 per dollar, strengthening from levels around 127.9 earlier. The Australian dollar was at $0.7095, lifting from around $0.706 earlier.

Oil prices were lower in the afternoon of Asia trading hours, with international benchmark Brent crude futures down around 1% to $112.30 per barrel. U.S. crude futures slipped nearly 1% to $109.23 per barrel.

— CNBC's Ted Kemp contributed to this report.

English (US) ·

English (US) ·