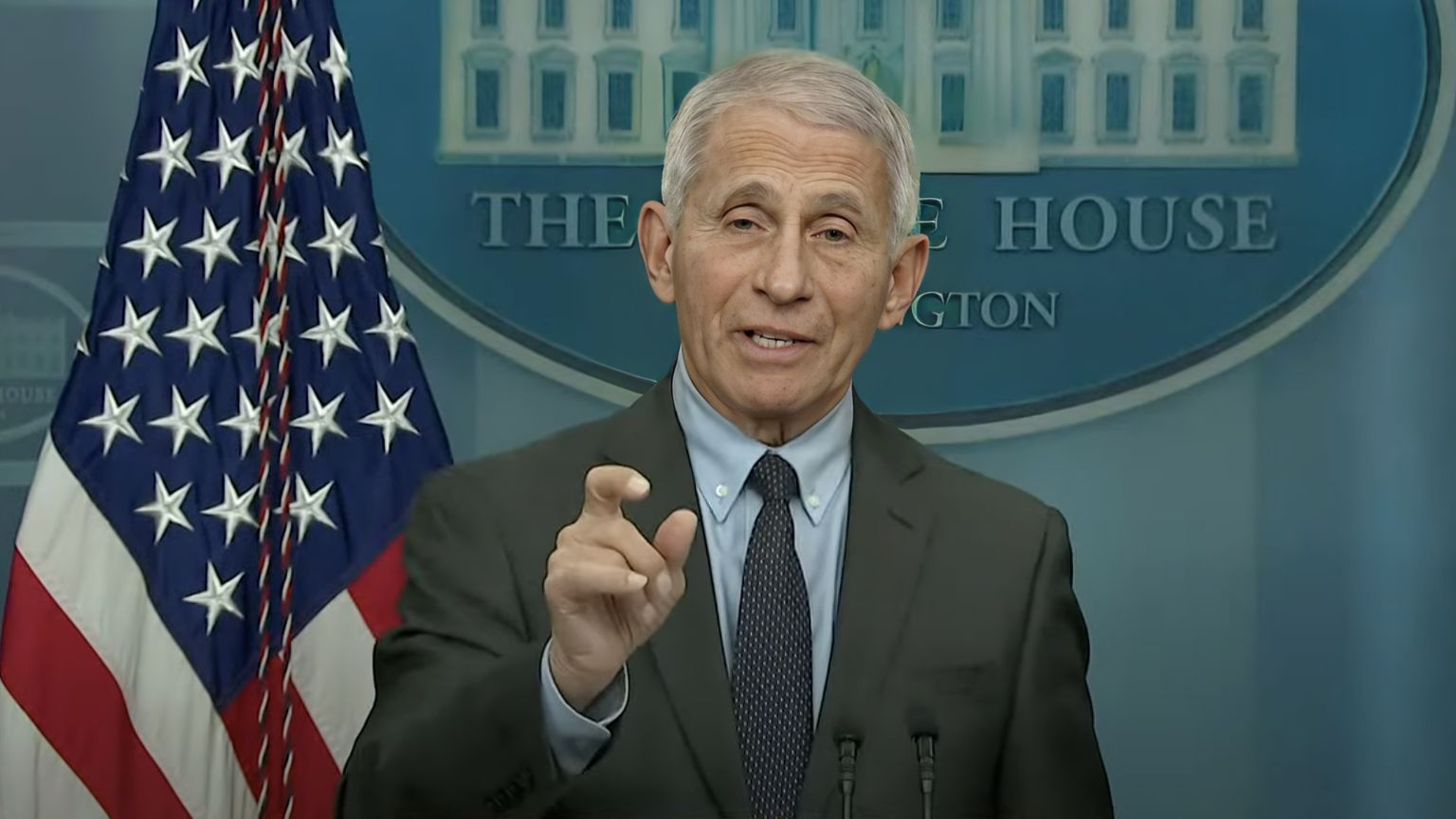

Tesla CEO Elon Musk is trying to buy Twitter and manage multiple companies at the same time.

James Glover II | Reuters

Billionaire Leo Koguan, who claims to be the third-largest individual shareholder of Tesla stock, is calling on the carmaker to announce a $15 billion stock buyback as the company's share price continues to fall.

In a tweet to Martin Viecha, Tesla's senior director of investor relations, Koguan said the company should immediately announce it plans to buy back $5 billion of Tesla shares this year and $10 billion next year. He added that Tesla should use its free cashflow to fund the buyback and that it shouldn't affect its existing $18 billion cash reserves.

In a follow up tweet, Koguan said Tesla's free cash flow amounted to $2.2 billion in the first quarter of the year. He added that he expects it to climb to $8 billion this year and $17 billion next year, after capital expenditures have been factored in.

In another tweet, he said Tesla can invest in full self-driving, its Optimus bot and new factories while also buying back its "undervalued stocks."

Tesla did not immediately respond to a CNBC request for comment.

Tesla shares closed down more than 6% on Wednesday amid a broad market sell-off. The company's stock has fallen more than 30% this year. Tesla was down slightly in morning trading Thursday.

A stock buyback — when a public company uses cash to buy shares of its own on the open market — is a method that firms use to try to return capital to shareholders.

Musk, the world's richest person on paper, said Tuesday that he's put his deal for Twitter "on hold" until he gets more information on how many fake or spam accounts there are on the social media network.

Analysts at Jefferies said Tuesday that Musk looks to be trying to drive down the price due to the recent market sell-off.

"Elon Musk's recent comments suggest he is trying to negotiate a lower offer price," equity analyst Brent Thill and equity associate James Heaney said in a research note.

"We believe that Musk is using his investigation into the % of fake TWTR accounts as an excuse to pay below $54.20/share. In reality, the NASDAQ COMP is down 25% YTD [year to date] and Elon Musk realizes that he may be overpaying for the asset." CNBC contacted Tesla to respond to the comments but did not receive a reply.

Wedbush analyst and Tesla bull Dan Ives told CNBC on Wednesday that Musk's plan to buy Twitter has been a "massive overhang" on Tesla's stock.

Ives, who says he has followed Musk for decades, said Musk has incurred a "black eye" in the last few weeks.

"The way he's handled this, I believe has been unconscionable," Ives said, adding it's "left a bit of a stain" on Tesla's stock.

English (US) ·

English (US) ·